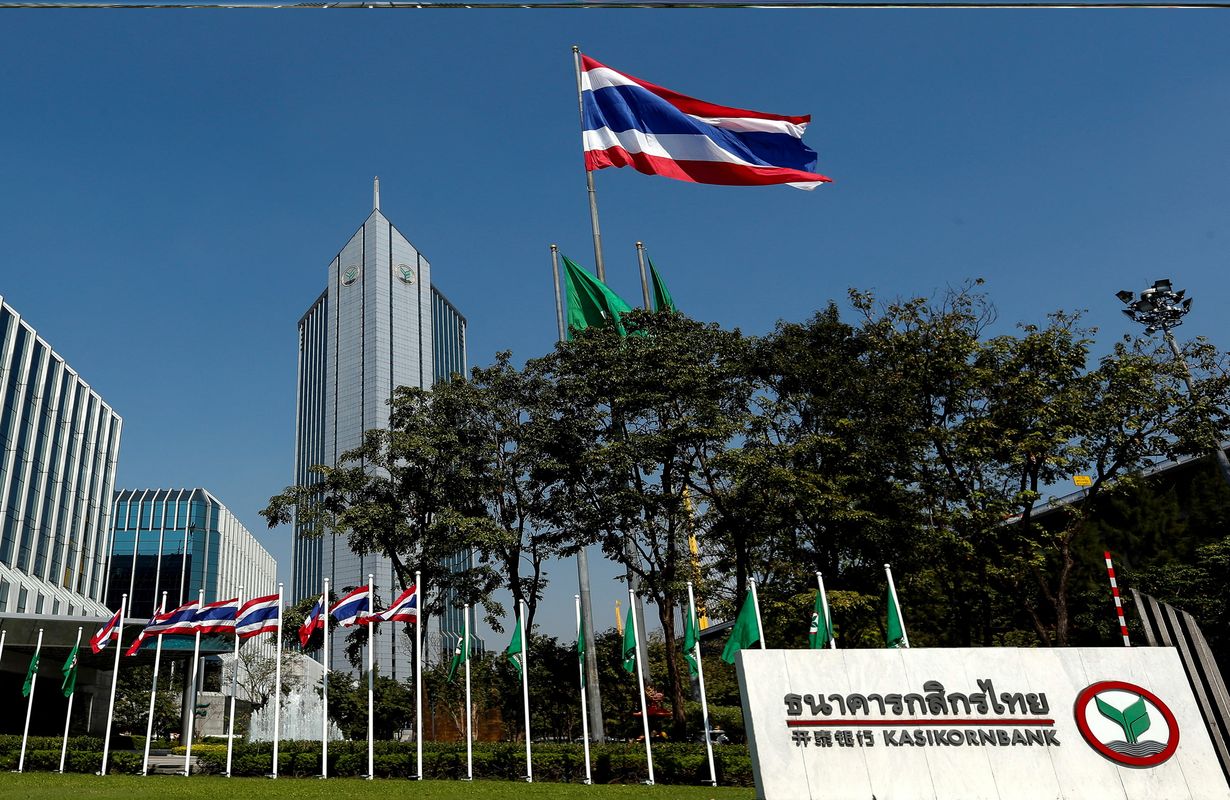

Kasikornbank, often called KBank, stands as one of Thailand's leading financial institutions. Founded in 1945, it has grown into a powerhouse in the banking sector. But what makes KBank so special? Is it their innovative services, customer-centric approach, or perhaps their commitment to sustainability? This blog post dives into 28 intriguing facts about Kasikornbank, shedding light on its history, achievements, and unique offerings. Whether you're a potential customer, a financial enthusiast, or just curious about global banking giants, these facts will provide a comprehensive look at what makes KBank tick. Get ready to discover the essence of Kasikornbank!

The History of Kasikornbank

Kasikornbank, one of Thailand's largest banks, has a rich history that spans several decades. Let's dive into some fascinating facts about its journey.

-

Founded in 1945: Kasikornbank was established on June 8, 1945, by Choti Lamsam. Initially named Thai Farmers Bank, it aimed to support the agricultural sector.

-

First Branch: The first branch opened in Bangkok's Yaowarat area, a bustling commercial district known for its vibrant Chinese community.

-

Name Change: In 2003, the bank rebranded from Thai Farmers Bank to Kasikornbank to reflect its broader range of services beyond agriculture.

Expansion and Growth

Kasikornbank has grown significantly since its inception, expanding its reach both domestically and internationally.

-

Over 1,000 Branches: The bank boasts more than 1,000 branches across Thailand, making it easily accessible to customers nationwide.

-

International Presence: Kasikornbank has established branches and representative offices in countries like China, Japan, and Vietnam, extending its services globally.

-

Digital Banking: Embracing technology, the bank launched K PLUS, a mobile banking app, which now has millions of users.

Financial Milestones

Kasikornbank has achieved numerous financial milestones, solidifying its position in the banking industry.

-

Stock Exchange Listing: The bank was listed on the Stock Exchange of Thailand in 1976, providing an opportunity for public investment.

-

Total Assets: As of recent reports, Kasikornbank's total assets exceed 3 trillion Thai Baht, showcasing its financial strength.

-

Revenue Growth: The bank has consistently reported strong revenue growth, driven by its diverse range of financial products and services.

Awards and Recognition

Kasikornbank's excellence has been recognized through various awards and accolades.

-

Best Bank in Thailand: The bank has received the Best Bank in Thailand award multiple times from prestigious financial publications.

-

Innovation Awards: Its commitment to innovation has earned it several awards for digital banking and financial technology.

-

Sustainability: Kasikornbank has been recognized for its efforts in promoting sustainable banking practices and corporate social responsibility.

Services and Products

Kasikornbank offers a wide array of services and products to cater to different customer needs.

-

Retail Banking: The bank provides comprehensive retail banking services, including savings accounts, loans, and credit cards.

-

Corporate Banking: It offers tailored financial solutions for businesses, from small enterprises to large corporations.

-

Investment Services: Kasikornbank provides investment advisory services, mutual funds, and wealth management solutions.

Community and Social Responsibility

Kasikornbank is committed to giving back to the community and promoting sustainable development.

-

Educational Programs: The bank supports educational initiatives, providing scholarships and funding for schools.

-

Environmental Initiatives: It has launched various projects aimed at environmental conservation and reducing carbon footprints.

-

Healthcare Support: Kasikornbank contributes to healthcare projects, including funding for hospitals and medical research.

Leadership and Management

Strong leadership has been a cornerstone of Kasikornbank's success.

-

Choti Lamsam: The founder, Choti Lamsam, played a pivotal role in establishing the bank's vision and direction.

-

Banthoon Lamsam: His grandson, Banthoon Lamsam, later took over as CEO, continuing the legacy and driving modernization efforts.

-

Diverse Board: The bank's board of directors includes experienced professionals from various fields, ensuring robust governance.

Customer-Centric Approach

Kasikornbank places a high emphasis on customer satisfaction and experience.

-

Customer Service: The bank is known for its excellent customer service, with dedicated support teams available 24/7.

-

Feedback Mechanisms: It actively seeks customer feedback to improve services and address concerns promptly.

-

Loyalty Programs: Kasikornbank offers loyalty programs and rewards for its customers, enhancing their banking experience.

Technological Advancements

Embracing technology has been key to Kasikornbank's success in the modern banking landscape.

-

K PLUS App: The K PLUS mobile app allows customers to perform a wide range of banking transactions conveniently from their smartphones.

-

Blockchain Initiatives: The bank has explored blockchain technology for secure and efficient financial transactions.

-

Cybersecurity: Kasikornbank invests heavily in cybersecurity measures to protect customer data and ensure safe online banking.

Future Prospects

Kasikornbank continues to look ahead, planning for future growth and innovation.

- Sustainable Growth: The bank aims to maintain sustainable growth by focusing on digital transformation, customer satisfaction, and community development.

Final Thoughts on Kasikornbank

Kasikornbank, often called KBank, stands out in Thailand's financial sector. Founded in 1945, it has grown into a major player with a strong focus on innovation and customer service. KBank's commitment to digital banking has made it a leader in the region, offering a range of services from mobile banking to investment solutions.

The bank's dedication to sustainability and social responsibility is evident through its various initiatives aimed at environmental conservation and community development. With a robust network of branches and ATMs, KBank ensures accessibility for its customers.

Whether you're interested in its history, technological advancements, or community efforts, Kasikornbank offers a compelling story of growth and innovation. Keep an eye on KBank as it continues to shape the future of banking in Thailand and beyond.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.